What is Preferred Coverage?

Preferred Coverage is a free healthcare benefit that lets you see the best doctors in your area for $0 out-of-pocket. Doctor rankings are based on real patient outcomes, using one of the nation’s largest medical databases and revolutionary analytics.

Have a question?

Find answers to the most commonly asked questions from our members and learn more about your Garner benefit.

Our aim is to help you navigate your benefits with ease and confidence, ensuring your Garner experience is even more rewarding.

Frequently asked questions

Below, you’ll find answers to the most common questions you may have about your Garner benefit. If you still can’t find the answer you are looking for, contact us!

About Garner

What is Garner?

Garner is a health benefits company that partners with your employer to reduce your out-of-pocket costs when you see certain high-quality doctors in your area.

What is Preferred Coverage?

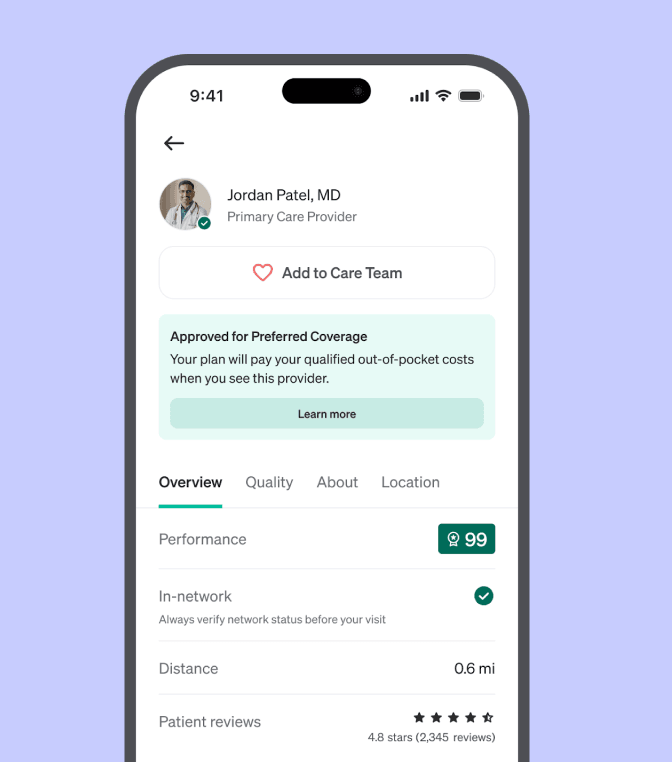

Preferred Coverage is a benefit that covers your out-of-pocket costs when you see certain high-performing doctors. Not all in-network doctors are approved for Preferred Coverage—you can find which doctors are approved for Preferred Coverage in the Garner Health app.

Is Preferred Coverage the same as in-network?

No. Preferred Coverage is different from your insurance network. Garner curates Preferred Coverage by identifying certain high-quality doctors. Only a subset of your in-network doctors are approved for Preferred Coverage. All doctors approved for Preferred Coverage are in-network, but not all in-network doctors are approved for Preferred Coverage.

Is Preferred Coverage my health insurance?

No. Preferred Coverage is not your health insurance. Preferred Coverage is a Health Reimbursement Account (HRA) that is paired with your health insurance plan to help you find high-quality, in-network doctors and covers your out-of-pocket costs when you visit them.

If I create an account, am I obligated to see doctors approved for Preferred Coverage?

No. While we encourage you to see approved providers to ensure you are receiving the best care, you have the choice to receive care from a doctor who is not approved for Preferred Coverage. Out-of-pocket costs from these doctors will not qualify for Preferred Coverage.

Why did my organization add Preferred Coverage to my plan?

Your employer cares about your health. To help you find the best care, they pay for you to have the Preferred Coverage benefit. High-quality care lowers healthcare costs - patients who see approved providers will generally pay less in the long run and be healthier. For example, if you have a smooth recovery, your total cost of care will be lower than if you have complications and need to be hospitalized.

Garner helps your employer pass these savings along to you through an innovative health reimbursement arrangement (HRA) - reduce your out-of-pocket costs by seeing the best doctors and staying healthy. It’s a win-win for everyone involved.

How does Garner make money? Can doctors pay Garner to be approved for Preferred Coverage?

Your employer or health plan sponsor pays Garner a small fee to access Preferred Coverage and enhance your health plan. Garner does not let doctors pay to show up in our recommendations.

Can my family use my Garner benefit?

Any dependent covered by your health insurance plan is eligible to use Garner to find providers approved for Preferred Coverage and have out-of-pocket medical costs covered. Your family only needs one account, but any dependent aged 18 or older is welcome to create their own account.

How do I see more details about my Preferred Coverage benefit?

You can log in to your Garner account and view more details here.

How do I use the app in Spanish?

To use the app in Spanish, log into your Garner account and navigate to your account settings here. Under the “Language” section, choose “Spanish” from the drop-down menu.

Finding providers approved for Preferred Coverage

What is an approved provider?

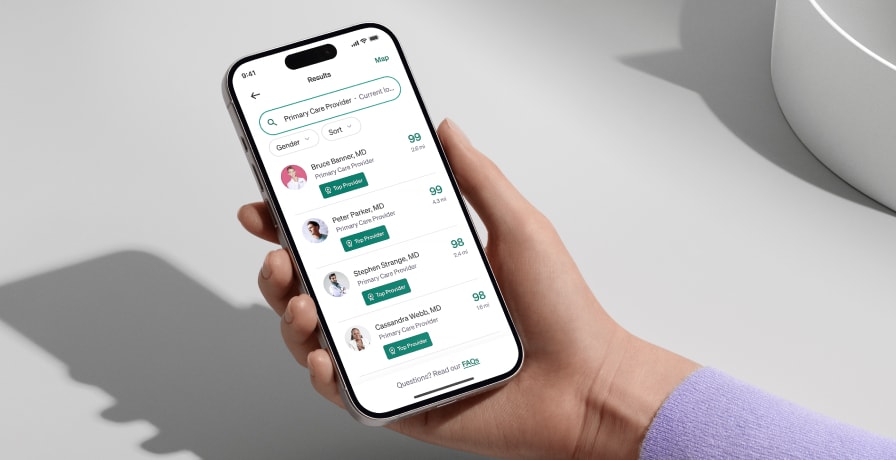

Garner identifies providers approved for Preferred Coverage by analyzing one of the largest medical claims databases in the U.S.—that’s more than 60 billion medical claims representing more than 310 million patients. They are highlighted in the Garner Health app with a green badge and banner and represent the best available doctors near you who are in your network and have appointment availability.

Are providers approved for Preferred Coverage in-network with my health insurance plan?

We try our best to recommend providers that are in-network with your health insurance plan. Since insurance companies change their networks regularly, we always recommend verifying with your health plan that a provider is still in-network on or before the day of service.

How do I find and add approved providers to my Care Team?

In the Garner app, you can search for doctors by symptom, name, or ZIP code. Look for the green badge—only these doctors are eligible for your Garner benefit.

How to Add a Doctor to Your Care Team:

Click “Find Care” in the navigation bar.

Use the search bar to enter a doctor’s name, specialty, condition, or procedure, then click “Find Providers.”

In the search results, select a doctor with the green badge to view their profile.

Click “Add to Care Team.” A red heart will fill in to confirm the doctor has been successfully added.

This ensures the doctor is approved for your benefit and easy to find later. You can access your full Care Team from the navigation bar.

Upon request, the Concierge can also assist with adding doctors to your Care Team.

Please note: To use Preferred Coverage for out-of-pocket costs, the doctor must be in-network, added to your Care Team before your appointment, and the services must be covered by your health insurance.

Where can I view my Care Team?

To view your Care Team, please log into your Garner account and select "Care Team" from the navigation bar.

Do I need to add my doctors to my Care Team every year?

No. Your list of doctors on your Care Team will carry over each year.

Does the list of doctors approved for Preferred Coverage ever change?

Yes, the doctors approved for Preferred Coverage can change. Garner’s recommendations are updated monthly based on the latest data. However, if a member has previously added an approved doctor to their Care Team, any recommendation updates will not affect the doctor’s approved status for that individual member and their dependents.

Are all providers at the same practice, medical center, or physician group approved for Preferred Coverage?

No. Garner evaluates the performance of individual doctors, not entire medical centers or hospitals. Use the Garner Health app to search for specific providers by name to see if they are approved for Preferred Coverage.

What if I see a mid-level provider, such as a nurse practitioner or physician’s assistant, instead of my approved doctor?

If you have an appointment with a doctor approved for Preferred Coverage and a nurse practitioner in their practice sees you instead, the costs from that visit will be eligible for Preferred Coverage.

To ensure your claim is processed as quickly as possible, message the Concierge through the Garner Health app and ask to have the nurse practitioner’s name added to your Care Team, even if it is after the date of service. Otherwise, Preferred Coverage may not cover your out-of-pocket costs until we are able to associate the mid-level provider you saw with a provider that has been added to your Care Team.

What if a colleague recommends an approved provider they found through Garner? Do I still need to add that provider to my Care Team?

Yes. Even if your colleague found a doctor approved for Preferred Coverage through Garner, you must search for that provider using your Garner account and add them to your Care Team before you receive care from them.

How do I know whether the specialist I have been seeing will be approved for my Preferred Coverage benefit?

Search for your specialist by entering their name and zip code. If your specialist has a green badge, your benefit can cover qualifying out-of-pocket medical costs from services performed or ordered by that specialist on or after the date you add them to your Care Team.

If your specialist is not an approved provider, you can still choose to receive care from them, but those out-of-pocket medical costs will not qualify for Preferred Coverage.

What if an approved doctor from my Care Team recommends I see a specialist?

All new providers, including specialists, MUST be approved for Preferred Coverage to qualify for the benefit. If you need to find a new provider, use the Garner Health app to find an approved provider or contact the Concierge for assistance.

Specialists must be added to your Care Team before the date of service in order for out-of-pocket medical costs to qualify for Preferred Coverage.

For example: If your primary care doctor recommends seeing a GI specialist for stomach pain, you must:

Search in the Garner app to confirm the specialist is approved.

If they are, be sure to add them to your Care Team before your appointment.

Why isn’t my current doctor covered by Garner?

We understand it can be disappointing if your current doctor isn’t approved for Preferred Coverage. Our mission is to help you access high-quality care while reducing your out-of-pocket costs.

How does Garner choose which doctors are approved for Preferred Coverage?

Garner identifies doctors approved for Preferred Coverage by analyzing one of the largest medical claims databases in the U.S.—that’s more than 60 billion medical claims representing more than 310 million patients.

We assess each doctor based on specific metrics related to their specialties, such as:

Complication rate: We measure a doctor’s complication rates

Invasive procedure rate: We determine if a doctor performs more invasive procedures only when necessary given they entail longer recovery times and complication risks

Follows current medical guidelines: We evaluate if a doctor recommends optimal treatment according to medical guidelines

The result? Seeing doctors approved for Preferred Coverage can make a meaningful difference in your health. For example, patients who see doctors approved for Preferred Coverage have experienced:

27% increase in receiving care that helps avoid unnecessary procedures and their associated risks

20% fewer hospitalizations for heart failure

31% fewer hospitalizations from diabetes.

If your doctor isn’t approved for Preferred Coverage, it doesn’t mean they aren’t a good provider—it simply means they haven’t met Garner’s criteria at this time. If you choose to continue seeing your current doctor, we respect your decision. However, please note that visits with non-approved providers are not eligible for Preferred Coverage.

We encourage you to consider a free second opinion from an approved provider to ensure you’re receiving the best possible care. You can always return to the Garner app to search for new doctors and get eligible out-of-pocket costs covered.

If you’re currently seeing a provider for a critical or ongoing care need, please reach out to Garner Concierge through the Garner app or email us at concierge@getgarner.com.

Qualifying Costs

What out-of-pocket medical costs qualify for Preferred Coverage?

Preferred Coverage covers qualifying out-of-pocket medical costs including office visits, lab work, imaging and procedures ordered or administered by doctors who were added to your Care Team before your appointment. To learn if other medical costs qualify for Preferred Coverage, log into your Garner account and navigate to the benefit section.

Your out-of-pocket medical costs will qualify for Preferred Coverage if:

You created a Garner account to find a doctor approved for Preferred Coverage

You added the doctor to your Care Team before your visit

The doctor is in-network and the cost is covered by your health insurance plan (check your health insurance plan to verify before your visit)

The service qualifies for Preferred Coverage under your Garner plan (check the “Coverage details” page to understand what services are covered under your plan)

You haven’t reached your maximum annual Preferred Coverage limit

(If your health insurance plan is paired with an HSA) You have met your annual spending requirement (Check the “Benefit details” page in the Garner Health app to see if this requirement applies)

When are services from facilities such as labs and imaging eligible for Preferred Coverage?

When an approved provider orders lab work or imaging, the associated out-of-pocket costs are eligible for Preferred Coverage if:

The approved provider was added to your Care Team before the date of service.

The facility is in-network, and the services are covered by your health insurance plan.

In this case, you do not need to search for the facility in the Garner Health app.

If You Choose to Find a Facility Yourself, you can also search for labs and imaging centers in the Garner Health app or website. To qualify for Preferred Coverage, the following conditions must be met:

You found the facility in the Garner Health app or website before your appointment

The facility’s profile page shows a green banner that says: “Approved for Preferred Coverage.”

The facility is in-network, and the services are covered by your health insurance.

Note: Garner strives to recommend in-network facilities, but insurance networks can change. Always confirm with the facility before your appointment. Garner does not recommend specific hospitals or facilities beyond those that meet the qualifications above. If you plan to use a facility that is not listed, ensure the provider ordering your care is approved for Preferred Coverage and is added to your Care Team before your appointment to have your out-of-pocket costs covered.

Can I get reimbursed for ancillary providers that I can’t select, such as an anesthesiologist who assists with surgery?

We understand you can’t choose ancillary providers such as anesthesiologists, radiologists and nurses. Your Preferred Coverage benefit will cover all qualifying out-of-pocket medical costs if:

The approved provider is added to your Care Team before your appointment.

The approved provider is ordering or is primarily performing the service.

The service is in-network with your health insurance plan.

To confirm coverage, check the list of services on your health insurance card or call the number on the card. If you have an online account with your health insurance provider, log in to your portal to confirm coverage details.

Can I use Preferred Coverage for out-of-pocket dental and vision care costs?

Preferred Coverage works with your medical insurance, which generally does not cover dental or vision services. Preferred Coverage may be used for qualifying out-of-pocket medical costs for procedures such as oral surgery, but only if the claim for that service is processed by your medical insurance plan.

If I don’t use my health insurance plan to cover procedures, can I still use Preferred Coverage?

No. Preferred Coverage only covers services processed by your health insurance plan.

Are prescriptions eligible for Preferred Coverage?

For more information on the services covered by your benefit, please log into your Garner account view your benefit details.

What is Continuity of Care?

Under Garner’s Continuity of Care policy, you may be granted an exception to use Preferred Coverage to cover expenses from a non-approved provider. This exception is designed to cover ongoing treatment for specific medical conditions until you can safely transfer to a provider approved for Preferred Coverage.

Pregnancy: For the duration of the pregnancy and through six weeks post-delivery

Newborn care: For a child from birth up to 36 months of age

Active cancer treatment: For new or relapses diagnosis currently receiving chemotherapy, radiation therapy, or reconstruction

Transplant care: For transplant candidates or recipients needing ongoing care

Post-surgery care: During the acute phase and follow-up phase for major surgeries

Acute conditions: During active treatment for serious events like heart attacks or strokes

Terminal illness: For ongoing treatment and management

Therapy and substance abuse: For established course of care

To qualify for a Continuity of Care exception, all three of these conditions must be met:

In-network provider: The specialist is on your health plan’s network

Covered service: The service is covered by your health plan

Concierge approval: The Continuity of Care exception is requested and approved through Garner Concierge before your visit

Medical circumstances that arise after the first Preferred Coverage plan year starts do not qualify for Continuity of Care exceptions.

What medical circumstances do not qualify for a continuity of care exception?

Continuity of care exceptions do not apply to medical services or circumstances that can be transferred safely from one provider to another, such as:

Routine exams

Vaccinations

Health assessments

Stable chronic conditions

Minor illnesses

Medical circumstances that arise after the beginning of the first Preferred Coverage plan year do not qualify for a Continuity of Care exception.

Using Preferred Coverage

How does Preferred Coverage work?

When you receive care from an approved provider who was added to your Care Team before your appointment, your medical plan will automatically cover eligible out-of-pocket costs using Preferred Coverage when they process the claim by paying the provider directly.

What do I need to do to use my Preferred Coverage benefit?

Preferred Coverage is automatically applied to eligible out-of-pocket costs when you see approved providers - no action needed from you.

What if I have a question about my Preferred Coverage benefit?

You can reach out to the Garner Concierge for answers to your Preferred Coverage questions by messaging them.

What if I have more questions about what is eligible for Preferred Coverage?

To learn more about what medical costs are eligible for Preferred Coverage, log in to your Garner account and check your benefit details or message the Concierge.

HSA and FSA Process

What if I have an HSA?

An HSA is a Health Savings Account (HSA). You and your organization are able to contribute pre-tax dollars to this account. Because of IRS requirements, you are required to spend a minimum amount toward your health insurance deductible before you can use your Preferred Coverage benefit. In 2026, once you have spent $1,700 for individuals or $3,400 for families, Preferred Coverage will begin to cover your out-of-pocket expenses. Note that this rule applies even if you are not actively contributing to your HSA this year.

Meeting this minimum amount doesn’t mean you have to wait to start using Garner. You can still set up a Garner account, search for doctors in advance of your visit, and ensure that your qualifying out-of-pocket medical costs will qualify for Preferred Coverage as soon as you meet the IRS out-of-pocket requirement.

What if I have an FSA?

If you have a health Flexible Spending Account (FSA), special rules apply to your Preferred Coverage benefit. You can’t use FSA dollars to pay for any expenses that your Preferred Coverage benefit already paid. This is referred to as double-dipping and is prohibited by the IRS. You can save your FSA for when your Preferred Coverage benefit has reached its limit or for out-of-pocket medical costs that do not qualify for Preferred Coverage (e.g., dental, vision).

What if I accidentally "double-dip" into my HSA or FSA?

If you believe you may have accidentally used HSA or FSA funds to pay for a claim that was covered by Preferred Coverage, there are some important next steps we’ll need to take.

If Garner confirms that HSA or FSA funds were used to pay for a claim that was covered using Preferred Coverage, Garner will reach out to the provider to request repayment for that amount. Once repayment is received, the amount will be credited back to your remaining Preferred Coverage benefit.

Concierge Support

What is the Garner Concierge?

The Garner Concierge is a group of professionals dedicated to answering your questions and helping you find the best care for you and your family. If you need help finding a provider approved for Preferred Coverage that is a fit for you or your family, you can message the Concierge for assistance.

How do I contact the Garner Concierge?

You can message through the Garner Health mobile app or email concierge@getgarner.com. Concierge hours of operations are Mon-Fri 8 a.m. to 10 p.m. ET. Se habla español.

Can't find the answer you're looking for?

Our dedicated Concierge is here for you. Concierge hours of operations are Mon-Fri 8 a.m. to 10 p.m. ET. Se habla español.