Using Garner

Our step by step guide will help you understand how your benefit works. Once you’ve got it down, you’re good to go!

Create your account

Create your free Garner Account. To get reimbursed for out-of-pocket expenses, you have to create an account and add your doctor to your Care Team before your appointment. Don’t worry. It won’t take more than a few minutes.

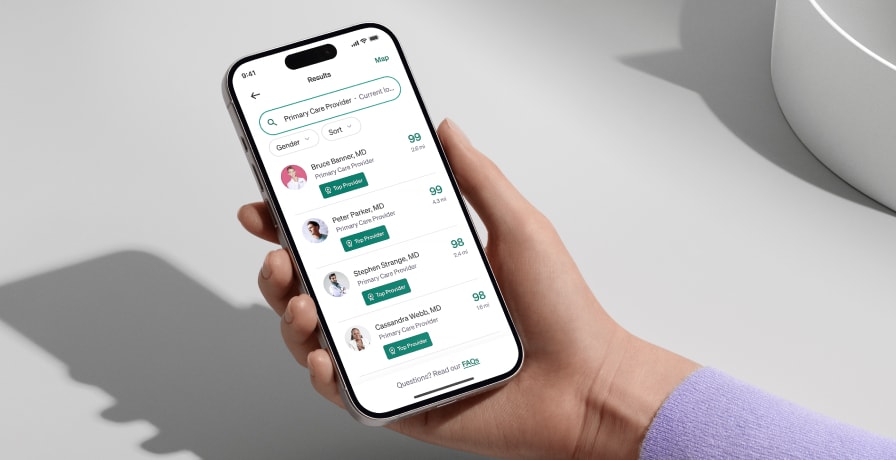

Find Top Providers

Garner ranks doctors based on real patient outcomes, using the one of the nation’s largest medical databases. You can seamlessly search for doctors in your area by symptom or name. Doctors with a green Top Provider Badge are eligible for reimbursement up to your benefit amount, including copays, office visits, medical tests and more.

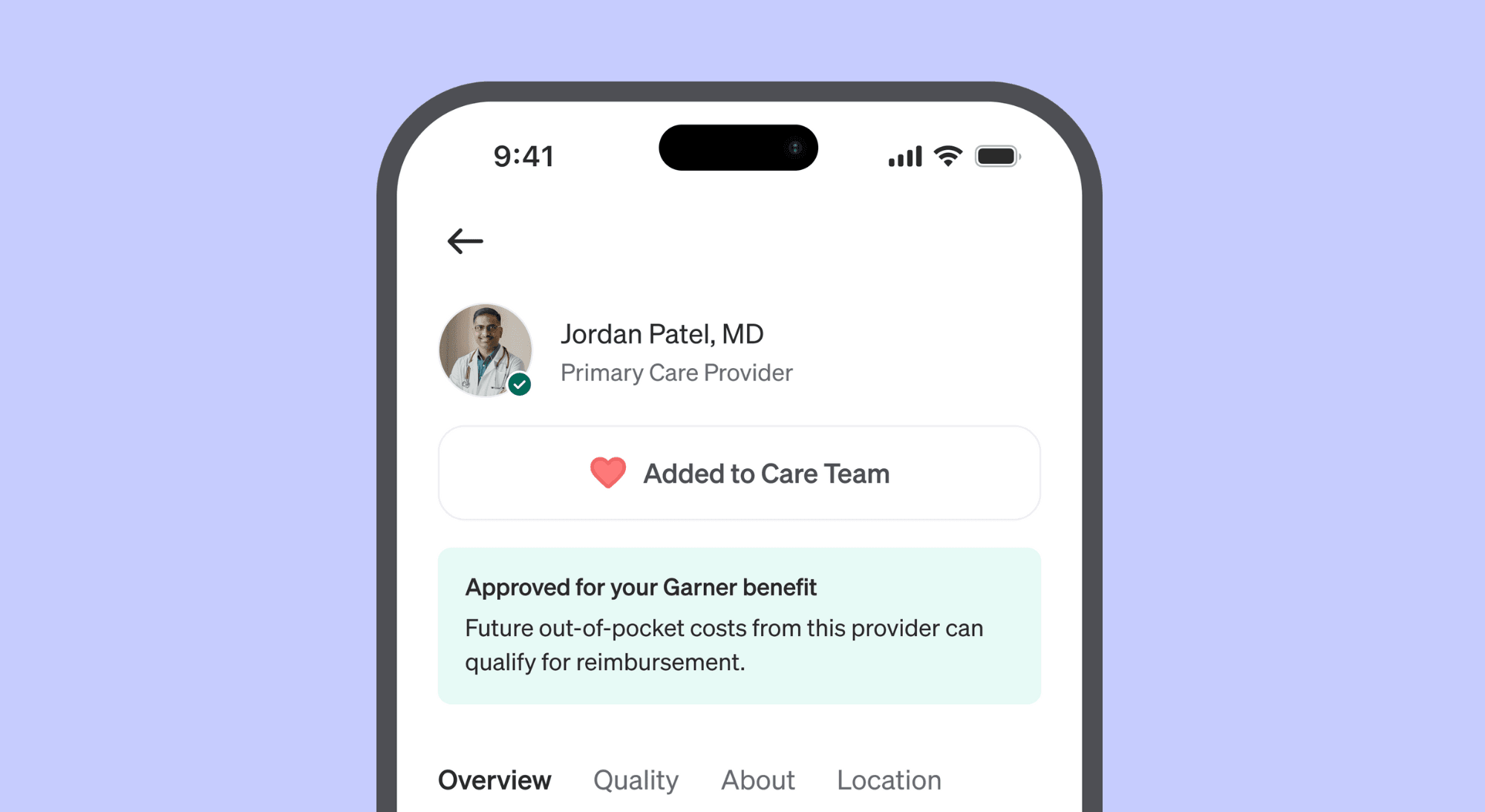

Add Doctors To Your Care Team

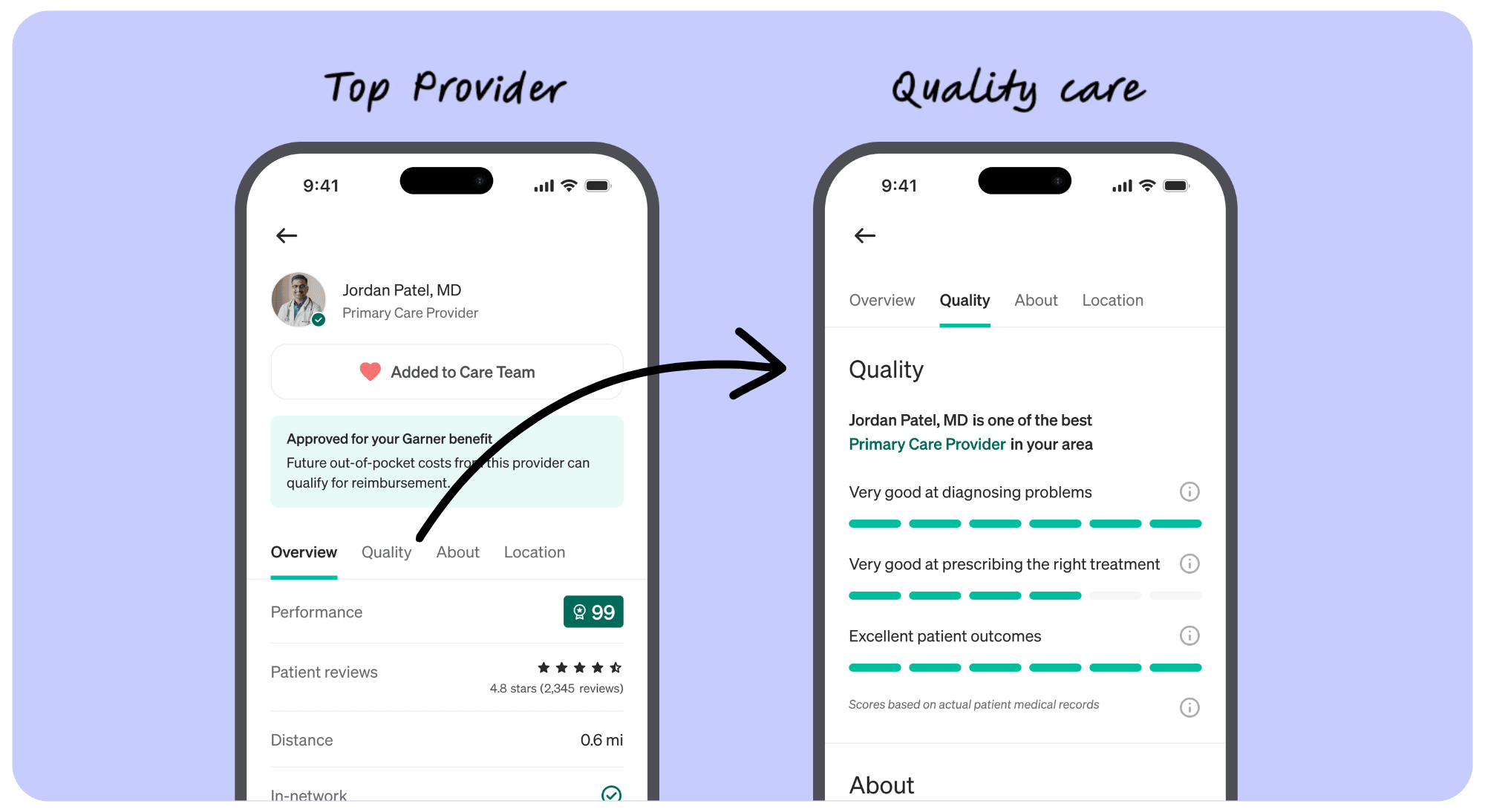

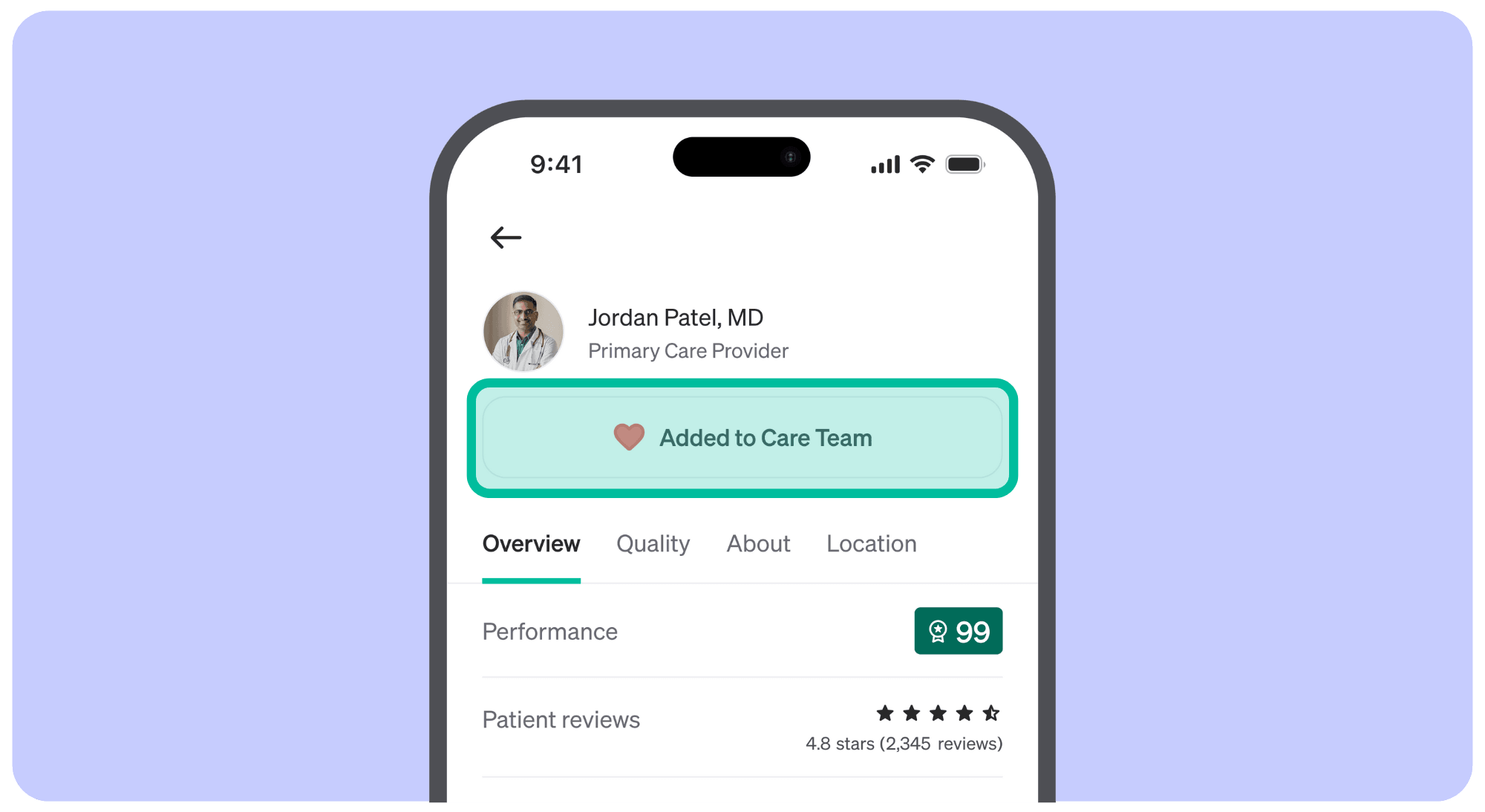

Don’t forget to add your doctors to your Care Team before your appointment. Click the "Add to Care Team" button on their provider profile. This confirms your doctor is approved for your Garner benefit and makes them easy to find later. Once added, these doctors will appear in your Care Team list and show a filled red heart on their profile.

Enjoy Quality Care

Not all doctors are created equal. Garner Top Providers help patients avoid unnecessary procedures and surgeries. In fact, patients who see Top Providers are 27% more likely to receive care that helps avoid unnecessary treatments.

Reimbursement Done for You

You don’t have to lift a finger. When you receive care from a Garner Top Provider, simply pay your upfront costs as usual. After your health insurance processes the claim, Garner will reimburse you for qualifying out-of-pocket medical costs.

Have a question?

Find answers to the most commonly asked questions from our members and learn more about your Garner benefit.

Our aim is to help you navigate your benefits with ease and confidence, ensuring your Garner experience is even more rewarding.

Frequently asked questions

Below, you’ll find answers to the most common questions you may have about your Garner benefit. If you still can’t find the answer you are looking for, contact us!

About Garner

Is Garner my health insurance?

No. Garner is not your health insurance. It is an additional benefit that complements your health insurance plan by helping you connect with in-network providers who offer quality care, have availability, and deliver optimal patient outcomes. By choosing these Top Providers, you not only ensure top-notch care but also become eligible for reimbursement of qualifying out-of-pocket medical costs.

If I create an account, am I obligated to see Garner’s Top Providers?

No. While we encourage you to see Top Providers to ensure you are receiving the best care, you have the choice to receive care from a doctor who is not a Top Provider. Out-of-pocket costs from these doctors will not qualify for reimbursement.

Why did my organization add Garner to my plan?

Your employer cares about your health. In order to help you find the best care, they pay for you to have the Garner benefit. High quality care lowers healthcare costs - patients who see Top Providers will generally pay less in the long run and be healthier. For example, if you have a smooth recovery, your total cost of care will be lower than if you have complications and need to be hospitalized.

Garner helps your employer pass these savings along to you through an innovative health reimbursement arrangement (HRA) - get paid to see the best doctors and stay healthy. It’s a win-win for everyone involved.

Can my family use my Garner benefit?

Any dependent covered by your health insurance plan is eligible to use Garner to find Top Providers and can be reimbursed for qualifying out-of-pocket medical costs. Your family only needs one account, but any dependent aged 18 or older is welcome to create their own account. Reimbursement checks will be mailed to the primary member who holds the health insurance plan.

How do I see more details about my Garner benefit?

You can log in to your Garner account and view more details here.

How do I use the app in Spanish?

To use the app in Spanish, log into your Garner account and navigate to your account settings here. Under the “Language” section, choose “Spanish” from the drop-down menu.

Finding Top Providers

What is a Top Provider?

Garner identifies Top Providers by analyzing one of the largest medical claims databases in the U.S.—that’s more than 60 billion medical claims representing more than 310 million patients. They are highlighted in the Garner Health app with a green Top Provider badge and represent the best available doctors near you who are in your network and have appointment availability.

Are Top Providers in-network with my health insurance plan?

We try our best to recommend Top Providers that are in-network with your health insurance plan. Since insurance companies change their networks regularly, we always recommend verifying with your health plan that a provider is still in-network on or before the day of service.

How do I find and add Top Providers to my Care Team?

In the Garner app, you can search for doctors by symptom, name, or ZIP code. Look for the Top Provider badge—only these doctors are eligible for your Garner benefit.

How to Add a Doctor to Your Care Team:

Click “Find Care” in the navigation bar.

Use the search bar to enter a doctor’s name, specialty, condition, or procedure, then click “Find Providers.”

In the search results, select a doctor with the green Top Provider badge to view their profile.

Click “Add to Care Team.” A red heart will fill in to confirm the doctor has been successfully added.

This ensures the doctor is approved for your benefit and easy to find later. You can access your full Care Team from the navigation bar.

Upon request, the Concierge can also assist with adding doctors to your Care Team.

Please note: To be eligible for reimbursement of out-of-pocket costs, the doctor must be in-network, added to your Care Team before your appointment, and the services must be covered by your health insurance.

Where can I view my Care Team?

To view your Care Team, please log into your Garner account and select "Care Team" from the navigation bar.

Do I need to add my doctors to my Care Team every year?

No. Your list of doctors on your Care Team will carry over each year.

Do the Garner Top Provider rankings ever change?

Yes, Garner Top Provider rankings can change. Garner Top Provider recommendations are updated monthly based on the latest data. However, if a member has previously added a Garner Top Provider to their Care Team, any recommendation updates will not affect the doctor’s approved status for that individual member and their dependents.

Are all providers at the same practice, medical center or physician group approved for the Garner benefit?

No. Garner evaluates the performance of individual doctors, not entire medical centers or hospitals. Use the Garner Health app to search for specific providers by name to see if they are a Top Provider and approved for your Garner benefit.

What if I see a mid-level provider, such as a nurse practitioner or physician’s assistant, instead of my approved doctor?

If you have an appointment with a Top Provider or an approved primary care physician, and a nurse practitioner in their practice sees you instead, the costs from that visit will qualify for reimbursement.

To ensure your claim is processed as quickly as possible, message the Concierge through the Garner Health app and ask to have the nurse practitioner’s name added to your Care Team, even if it is after the date of service. Otherwise, we may deny your claim until we are able to associate the mid-level provider you saw with a provider that has been added to your Care Team.

What if a colleague recommends a Top Provider they found through Garner? Do I still need to add that provider to my Care Team?

Yes. Even if your colleague found the Top Provider through Garner, you must search for that provider using your Garner account and add them to your Care Team before you receive care from them.

How do I know whether the specialist I have been seeing will be approved for my Garner benefit?

Search for your specialist by entering their name and zip code. If your specialist has a Top Provider badge, qualifying out-of-pocket medical costs from services performed or ordered by that specialist are eligible for reimbursement on or after the date you add them to your Care Team.

If your specialist is not an approved provider, you can still choose to receive care from them, but those out-of-pocket medical costs will not qualify for reimbursement.

What if an approved doctor from my Care Team recommends I see a specialist?

All new providers, including specialists, MUST be Top Providers in order to qualify for the Garner benefit. If you need to find a new provider, use the Garner Health app to find a Top Provider or contact the Concierge for assistance.

Specialists must be added to your Care Team before the date of service in order for out-of-pocket medical costs to qualify for reimbursement.

For example: If your primary care doctor recommends seeing a GI specialist for stomach pain, you must:

Search in the Garner app to confirm the specialist is a Top Provider.

If they are, be sure to add them to your Care Team before your appointment.

Why isn’t my current doctor covered by Garner?

We understand it can be disappointing if your current doctor isn’t covered by Garner. Our mission is to help you access high-quality care while reducing your out-of-pocket costs.

How does Garner select Top Providers?

Garner’s doctor recommendations are based on real patient outcomes to help you find the best doctors near you. Our recommendations go far beyond patient reviews. We look at billions of claims to understand the specifics of how doctors provide care.

Doctors can’t pay to show up in our recommendations. Garner is an objective third party that selects Garner Top Providers based on doctors who:

Follows current medical guidelines

Avoid unnecessary procedures

Charge fair prices for their services

Help patients recover faster

Garner Top Providers are the best doctors in each specialty and region of the country. Garner always looks for the best doctor option in your region, and accounts for the number of doctors available in your neighborhood.

How does Garner evaluate doctors? We assess each doctor based on specific metrics related to their specialties, such as:

Complication rate: Measure a doctor’s complication rates

Invasive procedure rate: Determine if a doctor performs more invasive procedures only when necessary given they entail longer recovery times and complication risks

Follows current medical guidelines: Evaluate if a doctor recommends optimal treatment according to medical guidelines

If your doctor isn’t listed as a Top Provider, it doesn’t mean they aren’t a good provider—it simply means they haven’t met Garner’s criteria at this time. If you choose to continue seeing your current doctor, we respect your decision. However, please note that visits with non-Top Providers are not eligible for Garner reimbursement.

We encourage you to consider a second opinion from a Garner Top Provider to ensure you’re receiving the best possible care. You can always return to the Garner app to search for new doctors and get reimbursed for future care that meets eligibility requirements.

If you’re currently seeing a provider for a critical or ongoing care need, please reach out to Garner Concierge through the Garner app or email us at concierge@getgarner.com.

Qualifying Costs

What qualifying out-of-pocket medical costs will be reimbursed?

Garner reimburses qualifying out-of-pocket medical costs that include office visits, lab work, imaging and procedures ordered or administered by doctors who were added to your Care Team before your appointment. To learn if other medical costs qualify for reimbursement, log into your Garner account and navigate to the benefit section.

Your out-of-pocket medical costs will qualify for reimbursement if:

You have created a Garner account and added the provider to your Care Team before the date of service.

Your provider is in-network and the cost was covered by your health insurance plan.

The type of cost qualifies for reimbursement under your Garner plan.

If your health insurance plan is paired with an HSA, you will need to incur costs greater than the “spending requirement.” The Garner app will show you how much more you have to spend before you can get reimbursed by Garner.

When are services from facilities such as labs and imaging eligible for reimbursement?

When a Top Provider orders lab work or imaging, the associated out-of-pocket costs automatically qualify for reimbursement if:

The Top Provider was added to your Care Team before the date of service.

The facility is in-network, and the services are covered by your health insurance plan.

In this case, you do not need to search for the facility in the Garner Health app.

If You Choose to Find a Facility Yourself, you can also search for labs and imaging centers in the Garner Health app or website. To qualify for reimbursement, the following conditions must be met:

You found the facility in the Garner Health app or website before your appointment.

The facility’s profile page shows a yellow banner that says: “Eligible with some exceptions.” This means services at the facility may qualify for reimbursement.

The facility is in-network, and the services are covered by your health insurance.

Note: Garner strives to recommend in-network facilities, but insurance networks can change. Always confirm with the facility before your appointment. Garner does not recommend specific hospitals or facilities beyond those that meet the qualifications above. If you plan to use a facility that is not listed, ensure the provider ordering your care is a Top Provider and is added to your Care Team before your appointment to remain eligible for reimbursement.

Can I get reimbursed for ancillary providers that I can’t select, such as an anesthesiologist who assists with surgery?

We understand you can’t choose ancillary providers such as anesthesiologists, radiologists and nurses. Your Garner benefit will reimburse all qualifying out-of-pocket medical costs if:

The approved provider is added to your Care Team before your appointment.

The Top Provider is ordering or is primarily performing the service.

The service is in-network with your health insurance plan.

To confirm coverage, check the list of services on your health insurance card or call the number on the card. If you have an online account with your health insurance provider, log in to your portal to confirm coverage details.

Does Garner reimburse out-of-pocket costs for dental and vision care?

Garner works with your medical insurance, which generally does not cover dental or vision services. Garner may reimburse qualifying out-of-pocket medical costs for procedures such as oral surgery, but only if the claim for that service is processed by your medical insurance plan.

If I don’t use my health insurance plan to pay for procedures, can I still get reimbursed by Garner?

No. Garner reimbursement occurs after costs are processed by your health insurance plan. Your health insurance plan must cover qualifying medical care and you must submit your out-of-pocket expenses to your insurance company for them to be eligible for reimbursement.

Can I be reimbursed for prescriptions?

For more information on the services covered by your benefit, please log into your Garner account and view your benefit details.

Reimbursement Process

How does reimbursement work?

When you receive care from a Top Provider who was added to your Care Team before your appointment, pay your upfront costs as usual. Garner has access to your insurance plan’s claims. After your health insurance company processes the claim, Garner will reimburse your qualifying out-of-pocket medical costs.

You have two options for receiving reimbursement:

Recommended - direct deposit: If you are the primary member you can set up direct deposit for faster and more secure reimbursement. Because the speed that billing departments submit claims to your health insurance company can vary, it typically takes 5-6 weeks to receive reimbursement after the service takes place. Watch this demo video to learn how to set up direct deposit.

If you do not set up direct deposit, a reimbursement check in a white envelope will be sent to the mailing address the primary member has on file with their employer, arriving in about 6-8 weeks.

How will my reimbursement arrive?

You have two options for receiving reimbursement:

If you are the primary member you can set up direct deposit for faster and more secure reimbursement. You will receive your reimbursement directly to your bank account and faster than a check. Watch this demo video to learn how to set up direct deposit.

If you do not set up direct deposit, a reimbursement check in a white envelope will be sent to the mailing address the primary member has on file with their employer.

What if I have a question about a reimbursement?

You can reach out to the Garner Concierge for answers to your reimbursement questions by messaging them.

What if I have more questions about what Garner will reimburse?

To learn more about what medical costs qualify for reimbursement, log in to your Garner account and check your benefit details or message the Concierge.

What do I need to do to be reimbursed?

Most of the time, you don’t need to do anything—reimbursement is automatic! However, if you have a medical claim over $2,000 or a prescription claim over $900, a member of the Concierge team will reach out to confirm your details before we send your reimbursement. This helps ensure security and accuracy for larger payments.

HSA and FSA Process

What if I’m enrolled in a plan with an HSA?

An HSA is a Health Savings Account (HSA). You and your organization are able to contribute pre-tax dollars to this account. Because of IRS requirements, two main rules apply.

First, if you have a high-deductible health insurance plan (HDHP) that is paired with an HSA, you are required to spend a minimum amount toward your health insurance deductible before you can utilize your Garner HRA. This amount changes annually and depends on whether you have a family or individual plan. Check the “Your benefit” page in the Garner Health app for more detailed information about this amount. Note that this rule applies even if you are not actively contributing to your HSA this year.

Second, you may not request reimbursement from your Garner HRA for any out-of-pocket cost you have already paid for using funds from your HSA. This is often referred to as double dipping and is prohibited by the IRS.

How does Garner work with an HSA?

If you have a Health Savings Account (HSA) paired with a High-Deductible Health Plan (HDHP), you must first spend the minimum amount toward your health insurance deductible. Once you have spent that amount, you can use the Garner Health Reimbursement Arrangement (HRA).

You are not required to spend HSA dollars on Garner-approved providers. However, we encourage you to seek care from Top Providers.

Garner keeps track of the claims we receive from your health insurance. Once you have spent $1,650 for individuals or $3,300 for families in 2025, or $1,700 for individuals or $3,400 for families in 2026, we will start issuing reimbursement checks for qualifying out-of-pocket medical costs.

Meeting your deductible doesn’t mean you have to wait to start using Garner. You can still set up a Garner account, search for doctors in advance of your visit, and ensure that your qualifying out-of-pocket medical costs will qualify for reimbursement as soon as you meet the IRS out-of-pocket requirement.

What if I have a FSA?

If you have a health Flexible Spending Account (FSA), special rules apply to your Garner benefit. You may not be reimbursed by the Garner HRA for an out-of-pocket medical cost that will also be paid using your FSA. This is often referred to as double-dipping and is prohibited by the IRS. If your Garner HRA and your FSA cover the same medical cost, we recommend you use and exhaust your Garner funds before using your FSA. You can save your FSA for when your Garner benefit has reached its limit or for out-of-pocket medical costs that do not qualify for reimbursement by Garner.

What if I accidentally "double-dip" into my HSA or FSA?

If you believe you may have accidentally submitted a claim for reimbursement that was already paid using HSA or FSA funds, there are some important next steps we’ll need to take.

Your Garner benefit works like a Health Reimbursement Arrangement (HRA), which is funded by your employer and not taxed as income to you. In contrast, Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are tax-advantaged accounts you fund yourself.

According to IRS guidelines, using HSA/FSA funds to pay for an expense and then getting reimbursed for that same expense through an HRA (like your Garner benefit) is considered “double-dipping”. This is not allowed because it results in receiving two tax benefits for the same expense.

If Garner confirms that reimbursement was issued for a claim already paid with HSA or FSA funds, and the payment has been received (via deposited check or direct deposit), Garner will reach out to request repayment for that amount. Once repayment is received, the amount will be credited back to your remaining Garner benefit.

Concierge Support

What is the Garner Concierge?

The Garner Concierge is a group of professionals dedicated to answering your questions and helping you find the best care for you and your family. If you need help finding a Top Provider that is a fit for you or your family, you can message the Concierge for assistance.

How do I contact the Garner Concierge?

You can message through the Garner Health mobile app or email concierge@getgarner.com. Concierge hours of operations are Mon-Fri 8 a.m. to 10 p.m. ET. Se habla español.

Can't find the answer you're looking for?

Our dedicated Concierge is here for you. Concierge hours of operations are Mon-Fri 8 a.m. to 10 p.m. ET. Se habla español.